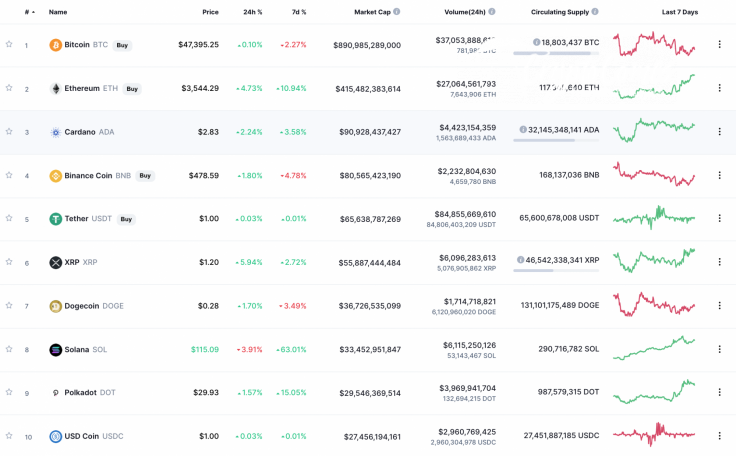

While the altcoins keep going up, the rate of Bitcoin (BTC) remains in the same place.

BTC/USD

The rate of Bitcoin (BTC) has gone down by 0.55% over the last 24 hours; however, bears have not seized the initiative yet.

On the hourly chart, Bitcoin (BTC) tested the formed mirror level at $47,460 and bounced off. There is a low chance that the decline will continue as the chief crypto has run out of power for a further drop while facing a strong leveling. In this case, the more likely scenario is a rise to the local resistance at $48,100.

On the 4H chart, Bitcoin (BTC) could not fix above $48,000, followed by an ongoing short-term decrease. The selling trading volume is going down, which means that buyers have the chance to make a reversal in the zone at $47,200 where most of the liquidity is focused.

On the bigger time frame, the main coin is trading in a sideways trend as neither bulls nor bears have seized the initiative. Buyers can become more powerful only if BTC breaks the resistance at $49,800 and fixes above it.

Bitcoin is trading at $47,477 at press time.